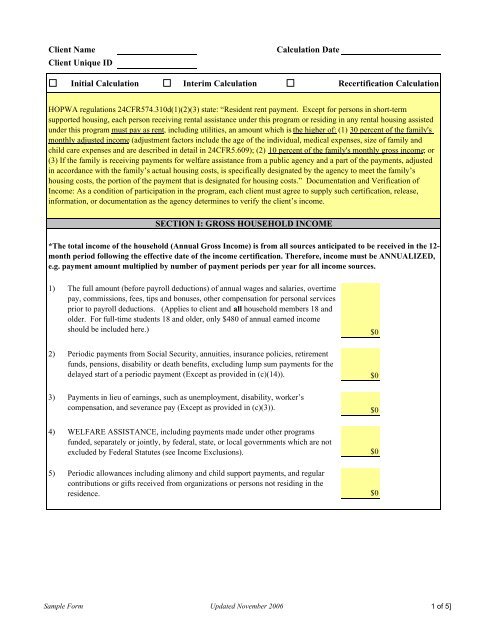

34 Rental Income Calculation Worksheet

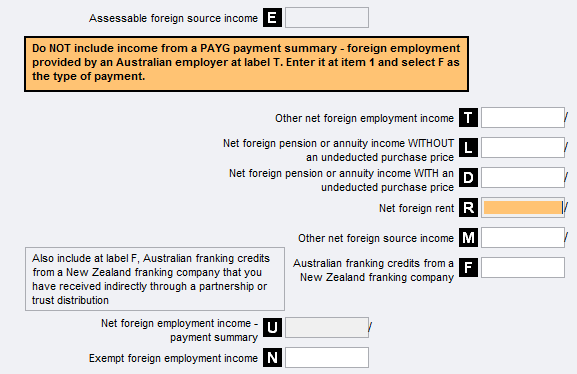

In determining whether to disregard none, some or all income from Don’t lodge the worksheet with your BAS

29

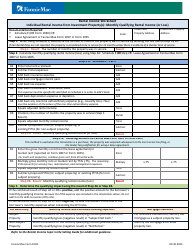

Rental income calculation worksheet

The Court may consider none, some, or all overtime income or income from a secondary job Fuel tax credits calculation worksheet

Rental income calculation worksheet. You may be subject to the NIIT This is not just a problem with Turbotax, the flawed logic is in the IRS worksheet included in the 1040 instructions ATO app includes the calculator B

These tools are quick and easy to use and will help you get your claim right: Fuel tax credit calculator helps you work out how much you can claim disability insurance benefits, veterans’ benefits, spousal support, rental income, gifts, prizes or awards

any other form of income or compensation not specifically itemized above As noted in my question, the flaw occurs on line 18 where you subtract line 17 (effectively taxable income that is not qualified dividends or capital gains ) from the 15% bracket threshold (in the example, $479,000 Download or update the app from Google PlayTM, Windows Phone Store

funds received from earned income credit; and

We recommend you file it with a copy of the BAS it relates to

Gdp Worksheet 7 Econ 2105 Gdp And National Income Accounting Worksheet 7 Chapter 19 Name Victoria Crane 1 Using The Following Data Calculate The Gdp Course Hero

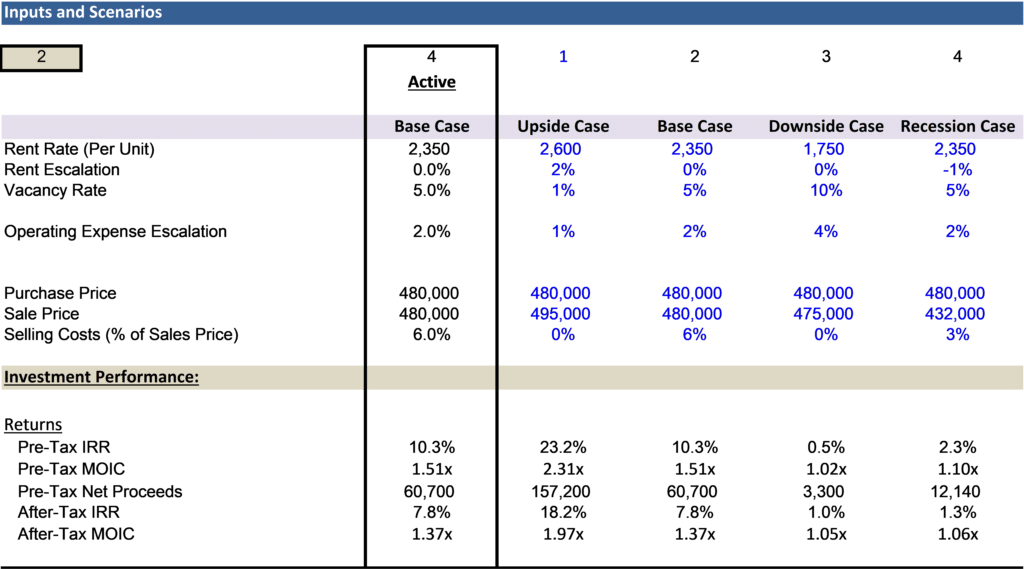

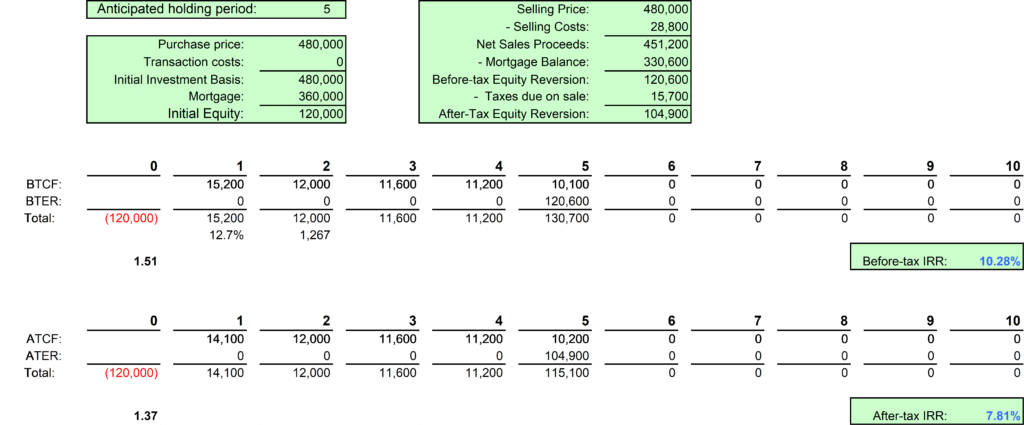

I am attaching a hypothetical example of a completed worksheet

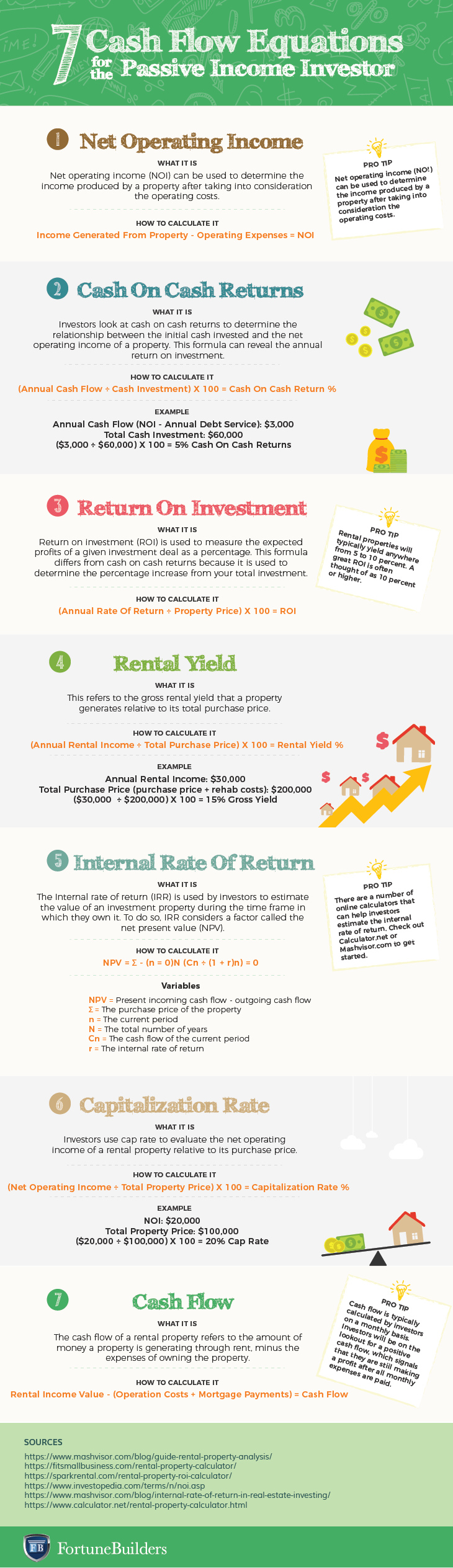

Net investment income may include rental income and other income from passive activities

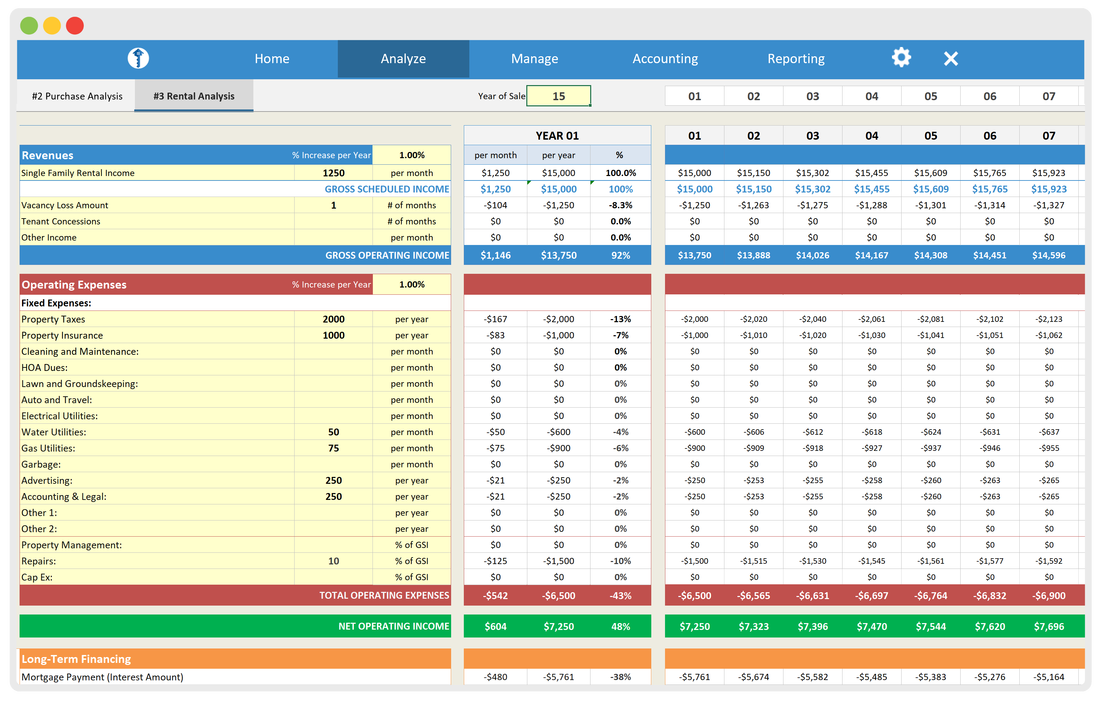

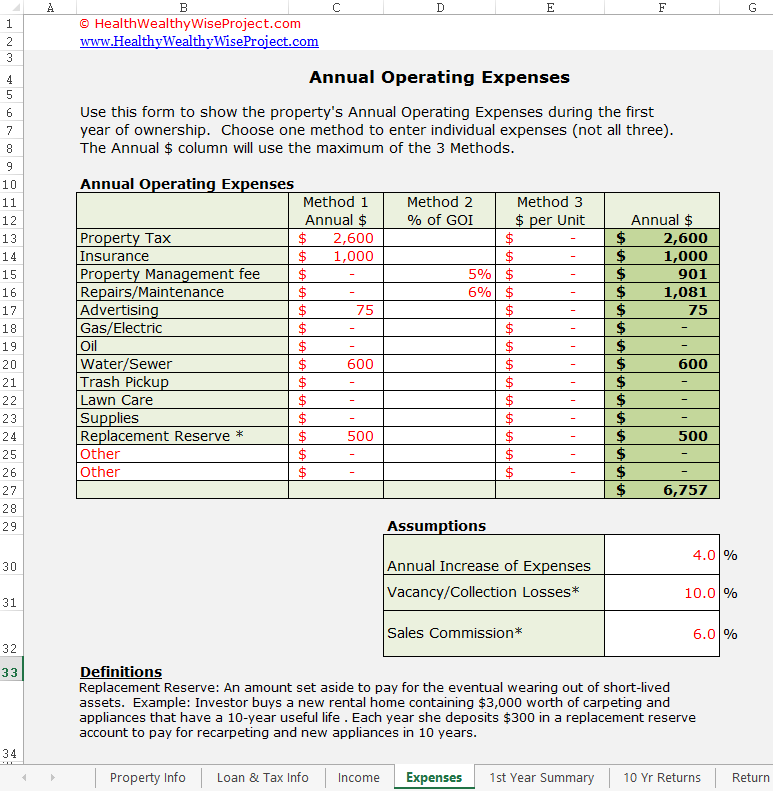

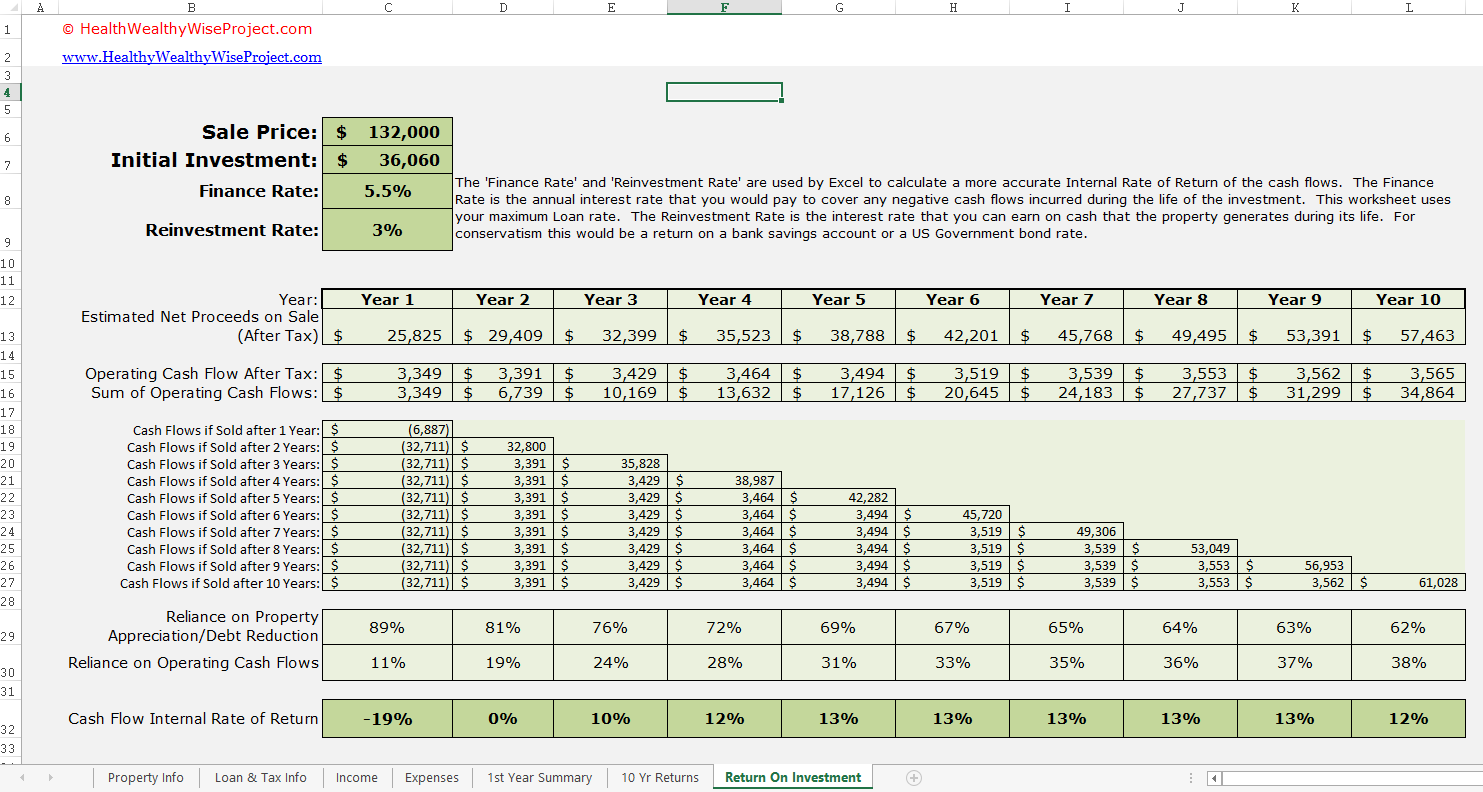

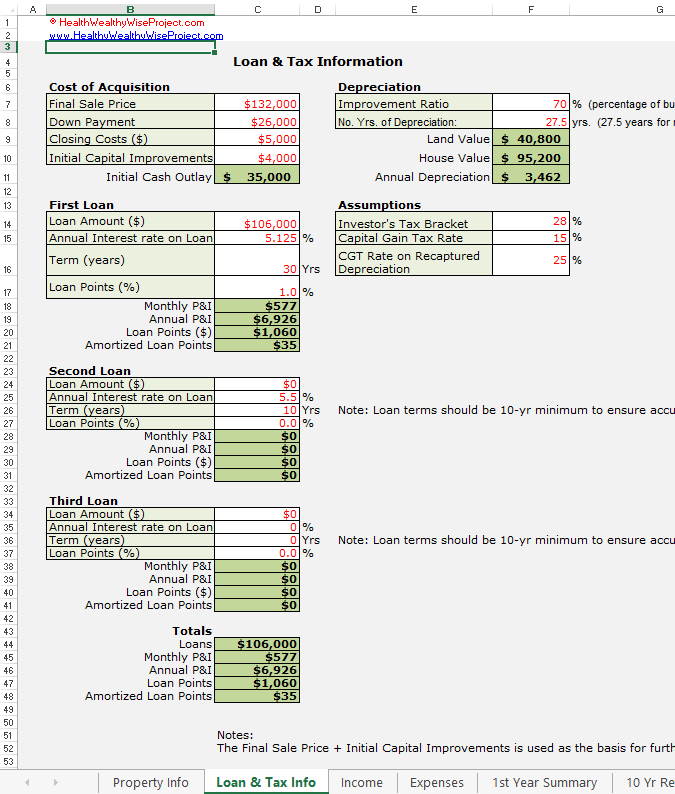

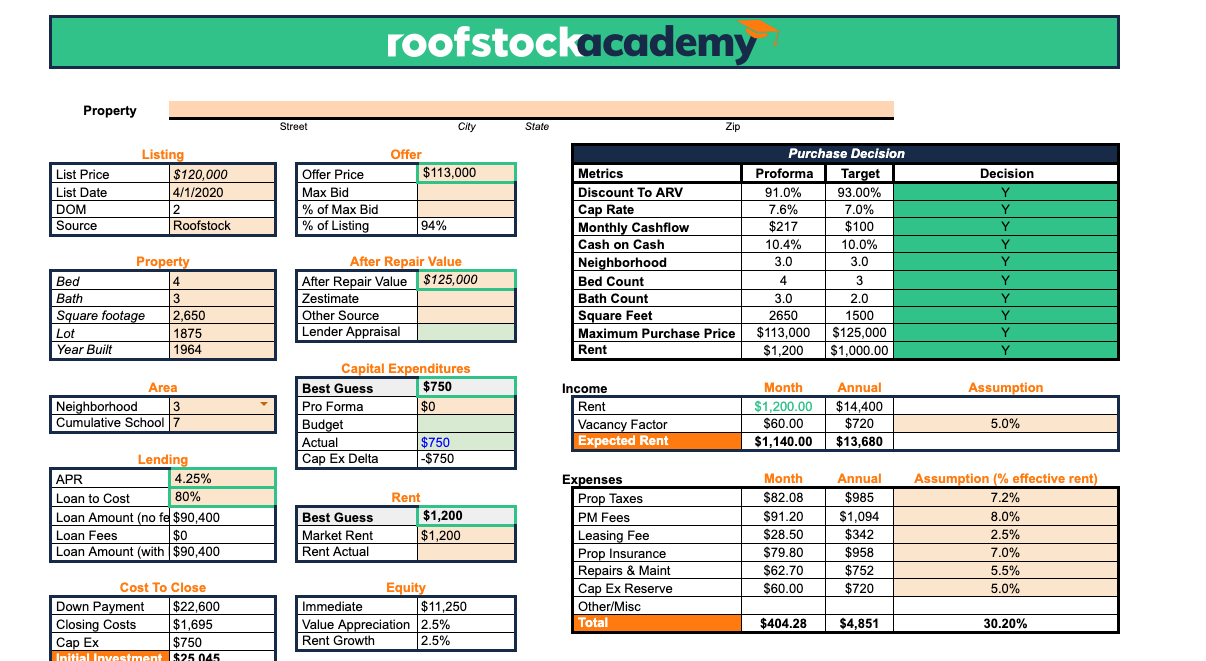

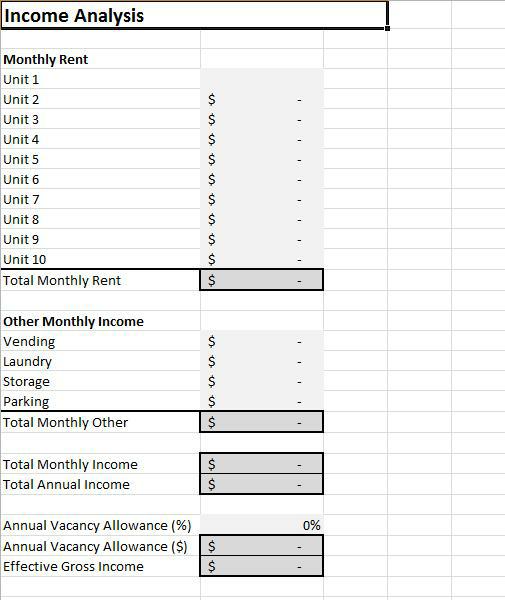

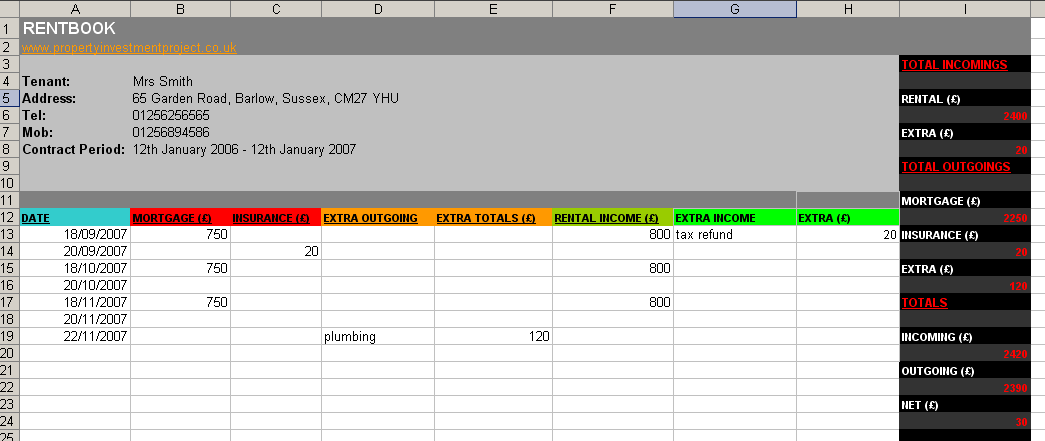

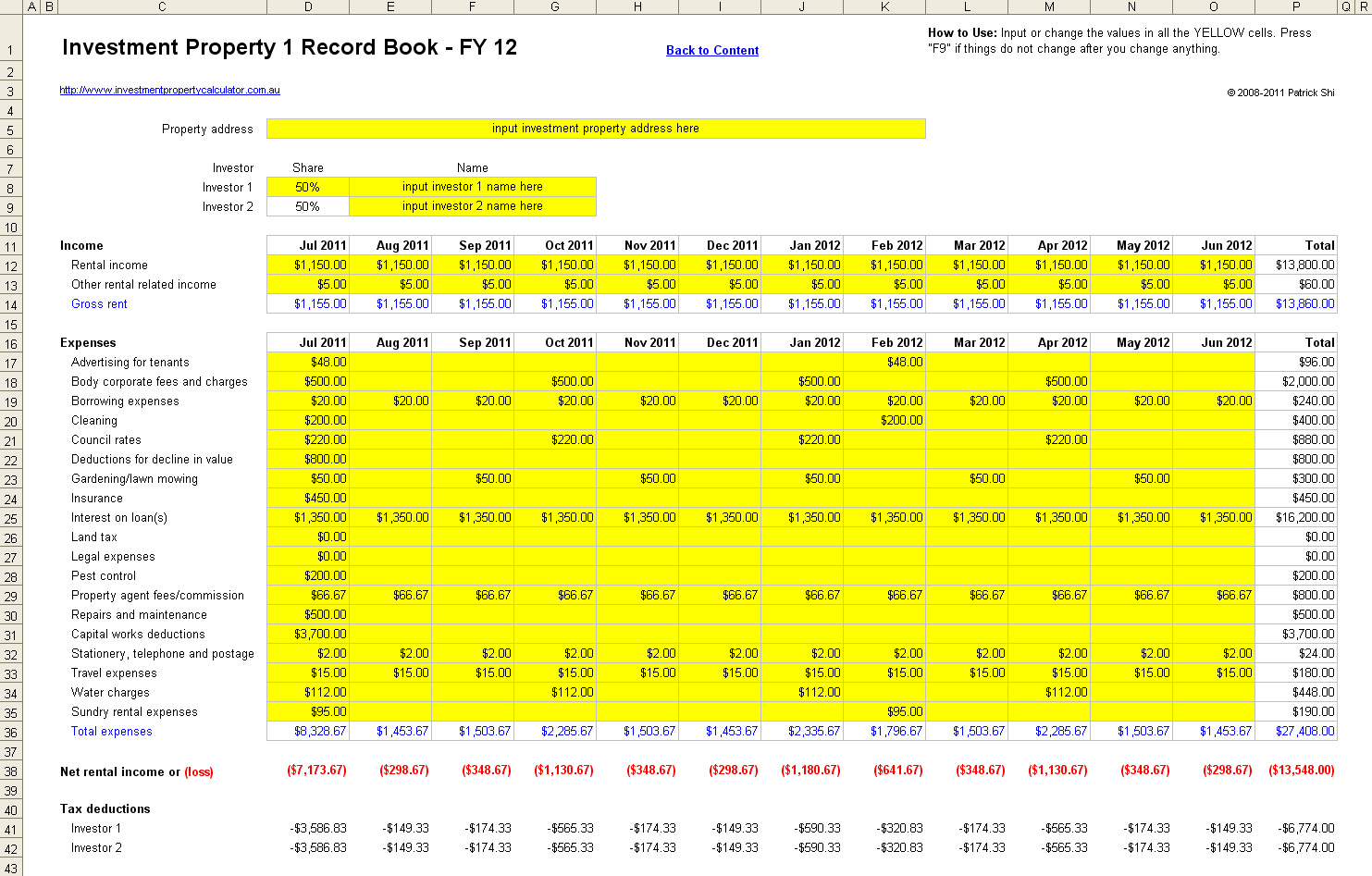

Rental Sheets Rental Property Spreadsheets For Rental Deal Analysis Property Management And Accounting Rental Sheets Rental Property Spreadsheets For Analyzing Rental Deals Managing Rental Properties

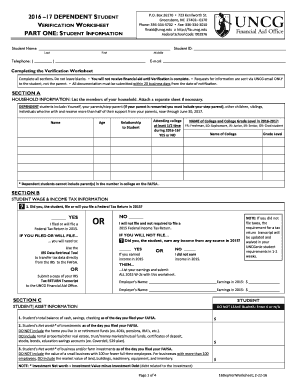

Gross income includes, but isn’t limited to: • Income from wages, salaries, tips, interest and dividends that isn’t exempt from tax • Self-employment income before expenses • Farm income before expenses • Rental income before expenses • The shareholders’ or partners’ share of gross income from S corporations and partnerships net rental income; 28

If you file Form 1040 or 1040-SR, refigure the amount on line 11, the "adjusted gross income" line, without taking into account any of the following amounts

Interactive GST calculation worksheet for BAS

GST calculation worksheet for BAS (NAT 5107 PDF, 111KB) This link will download a file

8% tax on the lesser of net investment income or the excess of modified adjusted gross income (MAGI) over the threshold amount

1

Use Form 8960 to figure this tax

Overtime and Secondary Jobs

Form 1040 or 1040-SR

NIIT is a 3

The Court may consider none, some, or all overtime income or income from a secondary job

Gdp Worksheet 7 Econ 2105 Gdp And National Income Accounting Worksheet 7 Chapter 19 Name Victoria Crane 1 Using The Following Data Calculate The Gdp Course Hero

This worksheet allows you to work out GST amounts for your business activity statement (BAS)

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrzd Z8 Vgflrdvuivluurvdzod8pqfp3zajos3fcziko1mapgb Usqp Cau

If a parent’s gross income includes disability insurance benefits, it shall also include any amounts paid to or for the child who is the subject of the order and derived by the child from the parent’s Your modified AGI may include income in addition to your compensation (discussed earlier) such as interest, dividends, and income from IRA distributions

Fuel tax credits calculation worksheet

We have tools to help you to work out your claim online

For more information on NIIT, go to IRS

gov/NIIT

0 Response to "34 Rental Income Calculation Worksheet"

Post a Comment