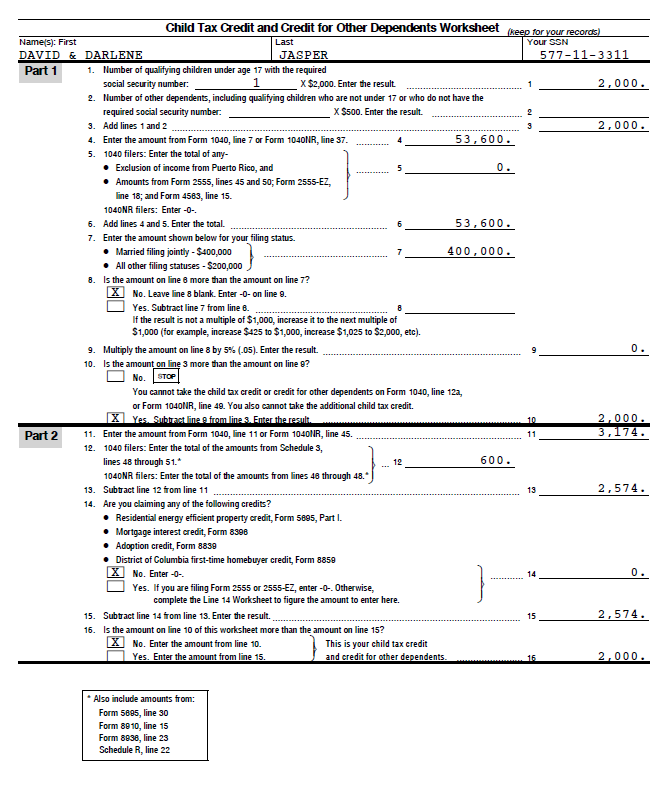

31 2012 Child Tax Credit Worksheet

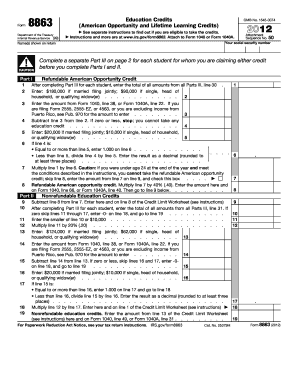

During 2020, she paid $6,000 for qualified education expenses This was her first year of postsecondary education

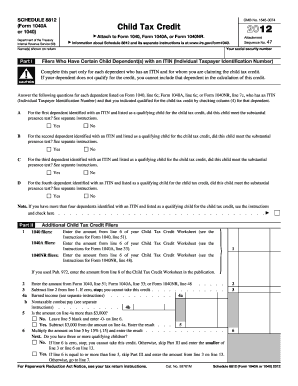

Jane has a dependent child, age 10, who is a qualifying child for purposes of receiving the earned income credit (EIC) and the child tax credit

2012 child tax credit worksheet

If the tax credit is worth more than what you owe the State of Maine in individual income taxes, you may use the balance over the following 10 tax years The EIC may also give you a refund

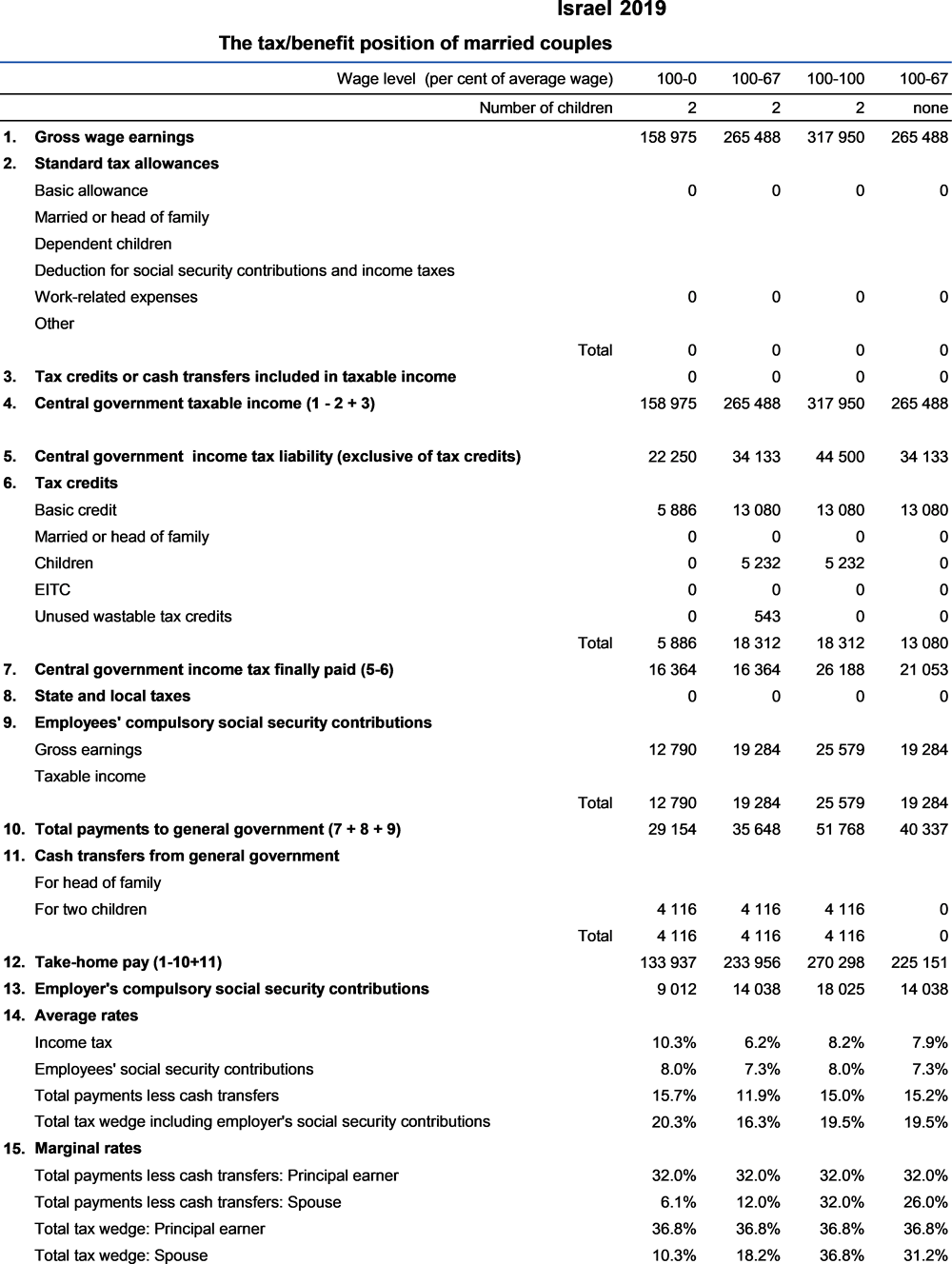

2012 child tax credit worksheet. The child tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a $400-per-child credit (which increased to $500 for tax years after 1998) and accounted for over 60 percent of the 10-year cost of the entire bill (Joint Committee on Taxation 1997) Child tax credit The EIC may also give you a refund These rules are summarized in Table 1

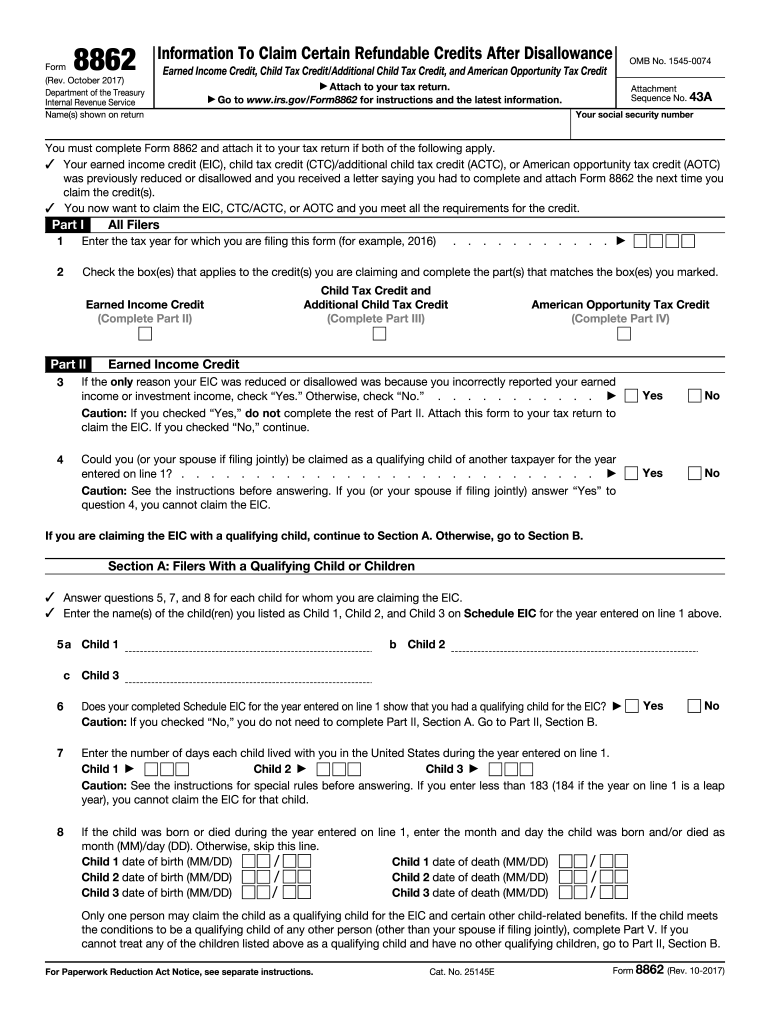

The earned income credit (EIC) is a tax credit for certain people who work and have earned income under $56,844 For Bachelors degrees NOT considered to be in STEM (science, technology, engineering or math) fields by Maine Revenue Services, tax credits may offset any individual income taxes you owe the State of Maine (non-refundable) A tax credit usually means more money in your pocket

Can I Claim the EIC? To claim the EIC, you must meet certain rules If the tax credit is worth more than what you owe the State of Maine in individual income taxes, you may use the balance over the following 10 tax years It reduces the amount of tax you owe She and the college meet all the requirements for the American opportunity credit

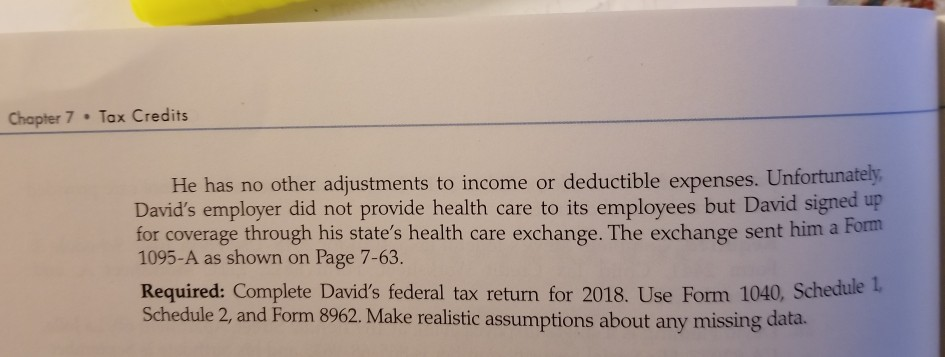

Solved 1 David Darlene Jasper Haveere Chll San 6 Year Old Bredate Haly 1 2012 Jaspers Reside 4 Q34565260

0 Response to "31 2012 Child Tax Credit Worksheet"

Post a Comment