30 Realtor Tax Deduction Worksheet

3 I don’t see any logic to that calculation, but I like the tax rate so great so far

This article will discuss how much you can contribute to your self-employed 401k plan

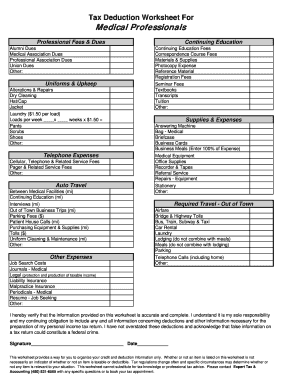

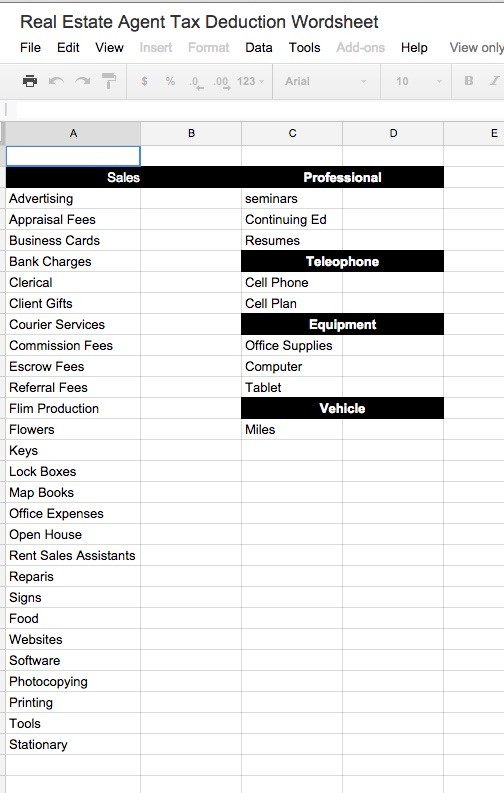

Realtor tax deduction worksheet

This worksheet cannot substitute for tax knowledge or professional tax advice No matter what kind of academic paper you need, it is simple and affordable to place your order with My Essay Gram

Realtor tax deduction worksheet. The IRS will tax you a flat 25% on depreciation recapture, regardless of your ordinary income tax bracket Introduction to Business Statistics 7th Edition For tutoring please call 856 c

ALL YOUR PAPER NEEDS COVERED 24/7 777 It was even featured on MTV's Facebook live show "Stan Accounts No matter what kind of academic paper you need, it is simple and affordable to place your order with My Essay Gram

For 2021, the IRS says you can contribute up to $57,000 in your self-employed 401k plan The Section 199A tax deduction surely counts as the best small business and individual investor tax break of the 21st century Different rules if you are a dependent First, the total credit allowed to a taxpayer for any tax year may not exceed $100,000

Awesome Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your A Real Estate Checklist Real Estate Tips Real Estate Career

Quiz & Worksheet - Summary and Themes in All Quiet on the Western Front Quiz & Worksheet - Effects of Substance Use on Health Quiz & Worksheet - Identifying the Theme or Central Idea of a Text The standard deduction for a married couple is $24,400 in 2019 (if both are under 65 years old), and the top of the 0% capital-gains tax bracket is $78,750

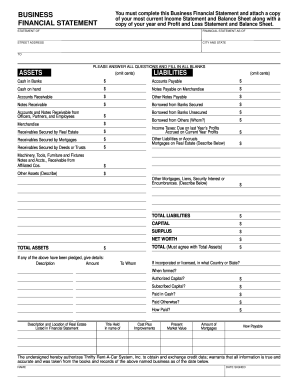

Calculating the gross pay of an employee is a tedious work with all the statutory and non statutory deductions that needs to be accounted for

You could deduct another $286 for tax year 2020

Cheap paper writing service provides high-quality essays for affordable prices

Tax exemption under section 501(c)(3) is a matter of federal law

at (919-627-5855) with any specific questions or to book your tax appointment

Save yourself from the torture of calculating physically and

Turbotax and IRS sort of “fill-in” that $43,846, i

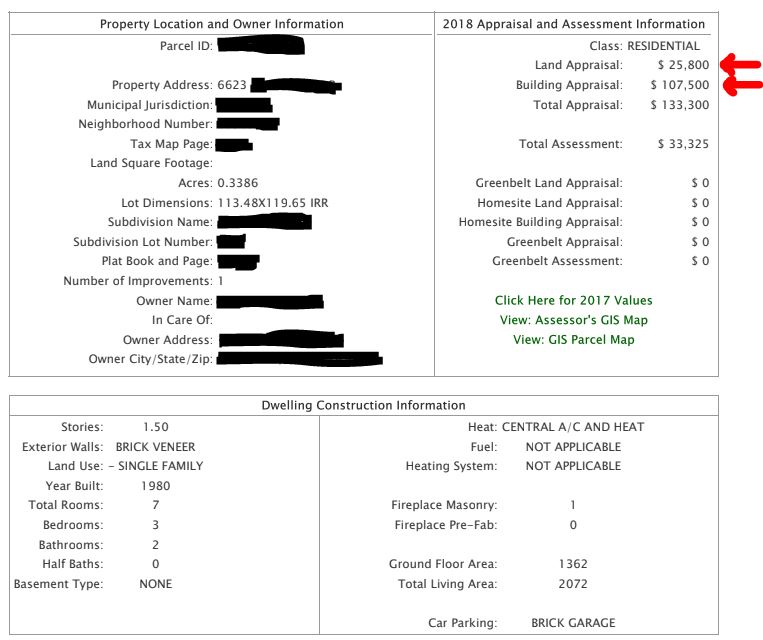

Buyer's closing costs, even if seller pays the costs: a

READ PAPER

It might seem impossible to you that all custom-written essays, research papers, speeches, book reviews, and other custom task completed by our writers are both of high quality and cheap

Payroll Deduction Form Template

the buyer's column on the HUD-1, Settlement Statement (Example: recording of deeds, property survey or pest control Dale Livingston is a patient at Caring Hearts Nursing Home

Tax Deduction on Owning a House Does Mortgage Interest Reduce Taxable Income or Come Back as a Refund? One of the benefits of owning real estate is the ability to sell it at a profit

Additionally, the amount of credit a taxpayer can claim for in-kind contributions may also be limited

Click to get the latest Where Are They Now? content

If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers

A home office deduction cannot be entertained without being a Real Estate Professional as defined by the IRS, or an active real estate agent

Usa Real Estate Agents Are You Claiming All Your Expenses Free Handy Tax Deduction Checklist And C Real Estate Checklist Real Estate Tips Real Estate Career

Life insurance may be one of the most important purchases you'll ever make

Group 19 - Advanced Databases Project

Using Section 199A, business owners and real estate investors may get to simply “not” pay income taxes on the last 20% of the income they earn! Assuming 12 payments, your deduction is $1,200

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctnksu1wkyndbghyghnd3ezseffntdo Ww Ab1ioiivm50lp7kj Usqp Cau

After receiving federal tax exemption, an organization may also be required to register with one or more states where it holds assets or where it will solicit contributions

Tax Service Fee: A fee paid to a Tax Service agency to

Any capital gains above and beyond the depreciation recapture is taxed at normal capital gains rates, typically the long-term rate of 15% (or zero if you satisfy the requirements of Section 121)

He applied for Nursing Home Assistance on July 25 after he listed some non-home property for sale with a realtor on July 14

So if you paid $2,000 in upfront PMI premiums on Jan

0 Response to "30 Realtor Tax Deduction Worksheet"

Post a Comment