30 Va Loan Calculation Worksheet

VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s). Review the VA funding fee rate charts below to determine the amount you'll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. For example: Let's say you're using a VA-backed loan for the first time, and you're buying a $200,000 home and paying a down payment of $10,000 (5% of the $200,000 loan). You'll pay a VA funding fee of $3,135, or 1.65% of the $190,000 loan amount.

Use this calculator to calculate your VA Max Mortgage from your remaining VA Entitlement, also called VA Loan Second-Tier Entitlement, and see if you will need a down payment. Select the Funding Fee Select fee 0.00 1.25 1.50 1.75 2.15 2.40 3.30

Note: This is just a Guide - Refer to VA Guidelines for any additional calculation information. (See Ncyclopedia for current max loan lim.) c) If Full Refinance, NOV/CRV x 90% 1 If applicable, the funding fee may be added to the base loan amount (not to exceed the GNMA maximum loan limit) OR it may be paid in cash. Mortgage.info. NMLS ID #1237615 | AZMB #0928735. 8123 South Interport Blvd. Suite A, Englewood, CO 80112 × When you're pursuing a Joint VA Loan, the loan limits you might be eligible for are different than if you are applying for a standard VA Home Loan. When considering joint borrowers, here is how the Department of Veteran Affairs figures how much it will guarantee: (Home price) ÷ (Number of borrowers) = Y.

Note: This is just a Guide - Refer to VA Guidelines for any additional calculation information. (See Ncyclopedia for current max loan lim.) c) If Full Refinance, NOV/CRV x 90% 1 If applicable, the funding fee may be added to the base loan amount (not to exceed the GNMA maximum loan limit) OR it may be paid in cash. Mortgage.info. NMLS ID #1237615 | AZMB #0928735. 8123 South Interport Blvd. Suite A, Englewood, CO 80112 × When you're pursuing a Joint VA Loan, the loan limits you might be eligible for are different than if you are applying for a standard VA Home Loan. When considering joint borrowers, here is how the Department of Veteran Affairs figures how much it will guarantee: (Home price) ÷ (Number of borrowers) = Y.

Va loan calculation worksheet. VA Loan Guaranty. Menu. Help; ... for an overview of the process. (NEW) 2/17/2021: Release 21.5. LGY Hub Guaranty Percentage Calculator. Guaranty Percentage Calculator. This calculator is for estimation purposes only. For more accurate and detailed information, please refer to the veteran's COE record. ... Entitlement used in previous loans and ... The Blue Water Navy Vietnam Veterans Act of 2019 changed how lenders calculate the guaranty for any VA home loan closed after Jan. 1, 2020. The changes apply only if you're buying, building or refinancing a home for more than $144,000. VA Loan Reader Questions: Does Rental Income Qualify as Verifiable Income for a VA Home Loan? A reader asks, "Can the rental income from a multi unit property be used at least partially to qualify for the loan?I know in the past that it could as long as the veteran had six months of cash reserve on hand to cover rental vacancies." A joint VA loan is a home loan backed by the U.S. Department of Veterans Affairs for a military borrower and one or more additional co-borrowers. The other borrowers don't have to be in the military, but they can be.

VA Loan benefits include a 100% no money down loan for the purchase of a home. There are several ways to decide if you can use those VA Loan benefits to purchase your next home. There's a formula for calculating Partial Entitlement on Veteran Home Loans, and just because you've used your Eligibility once, does NOT mean that you can not use ... 1a. Enter $36,000 entitlement for all loans < $144,000, or $ 1b. Enter 25% of the VA County Loan Limit for a 1-Unit Single-Family residence for loans > $144,000. $ 2. Less used entitlement (if applicable) -$ 3. Entitlement available for new loan $ MAXIMUM LOAN AMOUNT COMPUTATION 4. Lesser of property value per NOV or Sales Price $ 5. VA Pamphlet 26-7, Revised Chapter 7-Loans Requiring Special Underwriting, Guaranty and Other Considerations 7-6 1. Joint Loans, Continued i. Procedure VA calculates the guaranty as described in the table below. Step Action 1 Divide the total loan amount by the number of borrowers. 2 Multiply the result by the number of veteran-borrowers who will be Learn how the VA calculates your remaining VA Loan Entitlement and how it impacts your VA loan benefit. Published on January 7, 2021 Every Veteran who's eligible for a VA mortgage enjoys a certain level of entitlement — a dollar amount that the Department of Veterans Affairs is willing to repay a lender if you fail to make your payments.

Step 1: Calculate your maximum VA loan limit at your new base, which according to the VA is located here. For most areas this amount will be $417,000. For most areas this amount will be $417,000. Assuming I am moving to Robins AFB, my new loan limit for Houston County, GA, is $417,000. In other words, a VA loan can be used to purchase a property at a price greater than the county limit, but a down payment will be required. This type of loan is commonly called a VA Jumbo loan. Let's examine exactly how to calculate the down payment required when purchasing a home above the VA county loan limit: Example: Purchase Price: $950,000 As was the case with your original VA loan, you can wrap these costs into your new loan amount on the VA IRRRL. Figuring it All Out. Figuring out the VA IRRRL max loan amount can see confusing. Here is an example to help make it easier for you: Joe has a current outstanding principal balance of $100,000 on his VA loan. In this example, the maximum VA loan would be four times $11,000, or $44,000. If the remaining entitlement were $20,000, the maximum loan amount would then be $80,000. In each example, the maximum loan amount wouldn't finance very many properties due to the smaller, allowable loan limits.

Effective immediately, PennyMac is aligning with VA's student loan payment calculation requirement, and Lenders may begin using VA's updated guidelines. PennyMac understands that VA provides lenders broad authority in approving loans, and will accept loans that were qualified prior to the publication of the circular.

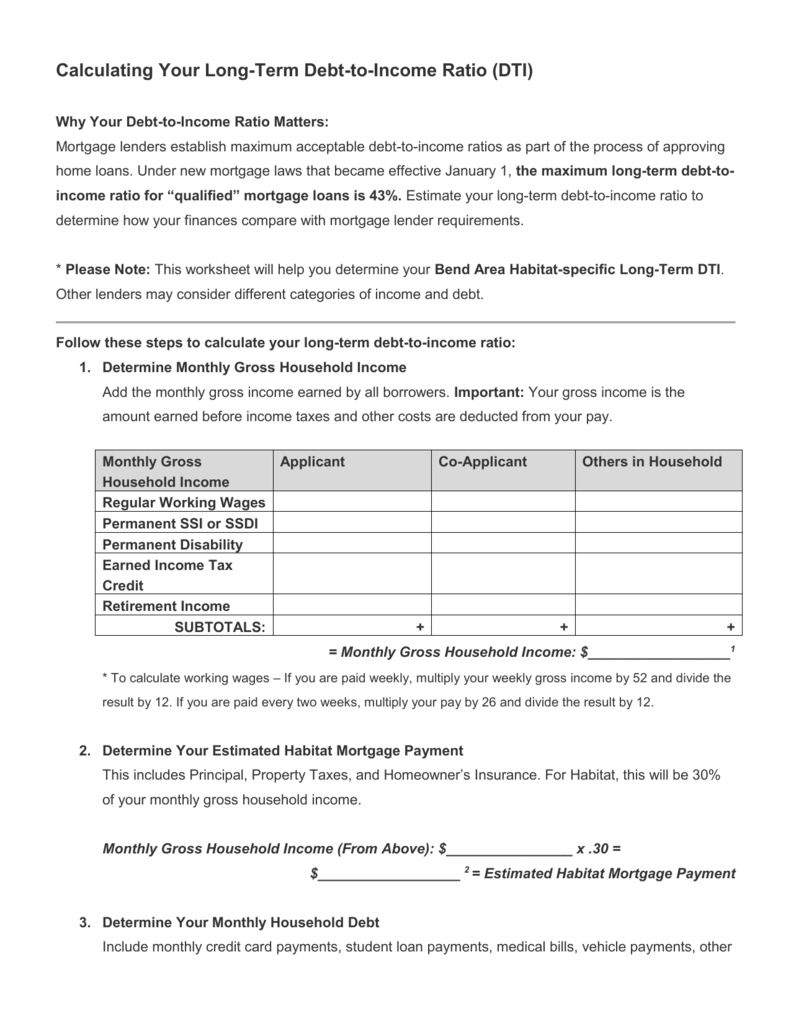

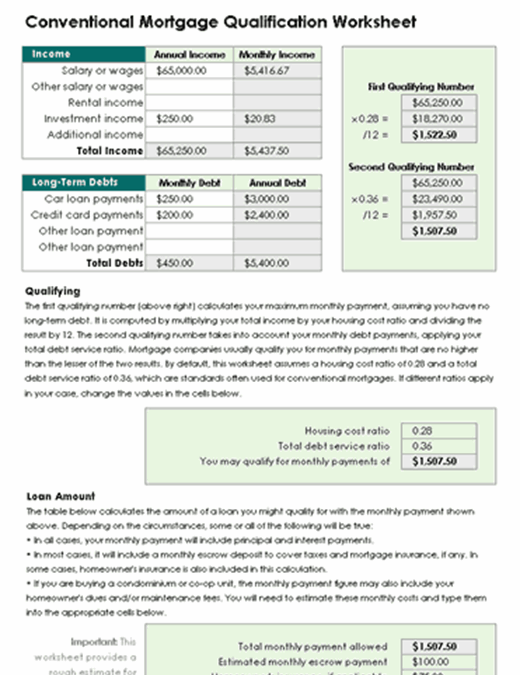

Calculating your long term debt to income ratio dti

Calculating your long term debt to income ratio dti

Download a VA Max Loan Amount Calculation Worksheet | Speak with one of our Licensed Mortgage Bankers help in calculating the VA Funding Fee and understanding the VA Max Loan Amount Calculation Worksheet. Established in 1998, Foundation Mortgage is an approved Miami, Florida VA Loan Lender with locations In Miami, Miami Beach, Boca Raton, Lake Worth, West Palm Beach and Tampa Florida.

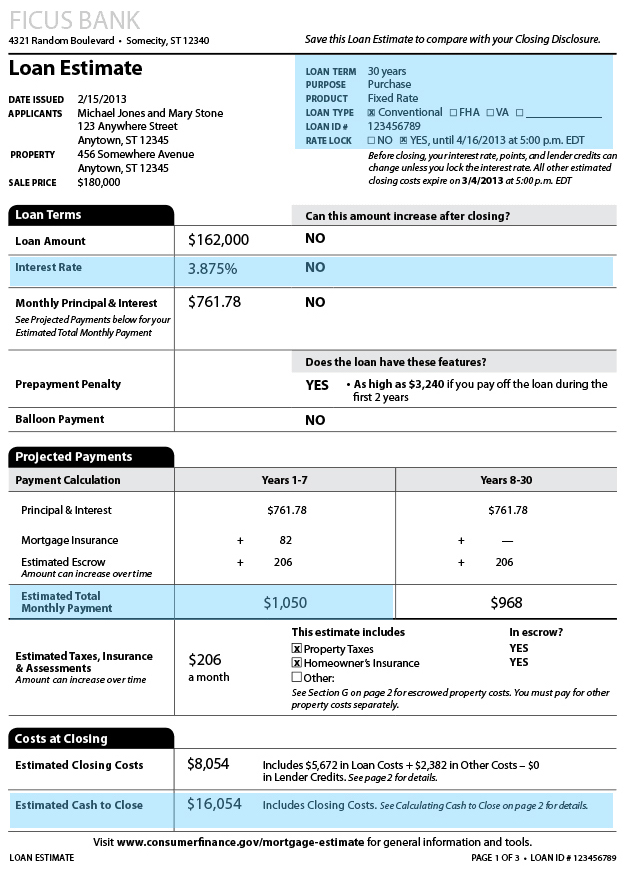

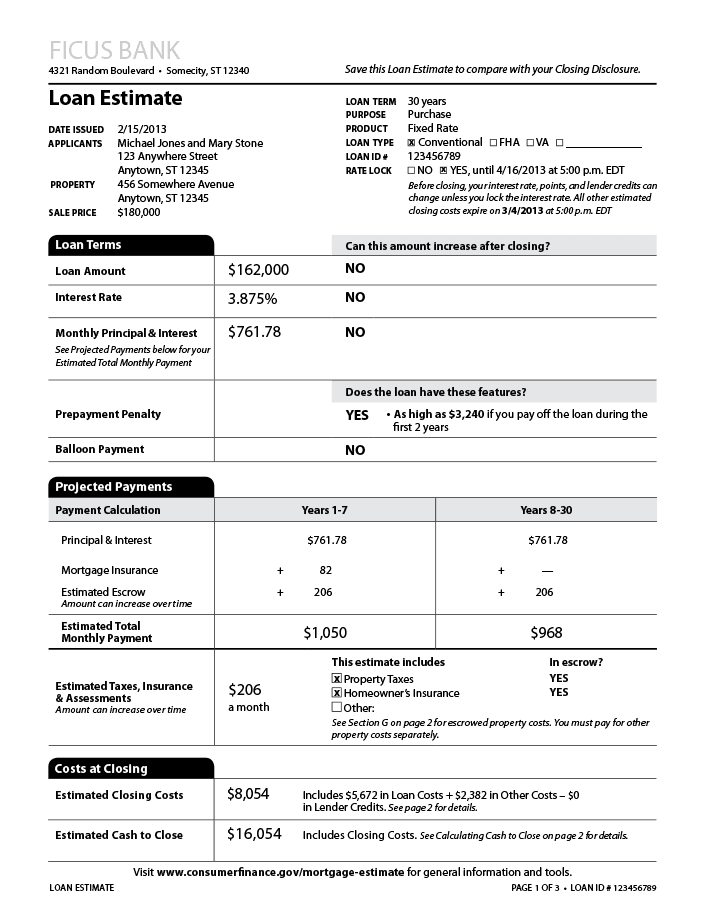

How to read a mortgage loan estimate formerly a good faith

How to read a mortgage loan estimate formerly a good faith

In this case, the borrower used $70,000 of entitlement on a prior VA-guaranteed home loan (not restored). The borrower is seeking to purchase another home with a loan amount of $200,000. County loan limit of the property is $600,000. $150,000 ($600,000 x 25%) OR $200,000 (loan amount) - $70,000 (entitlement used) x 25%

Va maximum entitlement worksheet printable worksheets and

Va maximum entitlement worksheet printable worksheets and

Note: This is just a Guide - Refer to VA Guidelines for any additional calculation information. (See Ncyclopedia for current max loan lim.) c) If Full Refinance, NOV/CRV x 90% 1 If applicable, the funding fee may be added to the base loan amount (not to exceed the GNMA maximum loan limit) OR it may be paid in cash.

It depends. If you apply and are eligible for a VA-backed home loan, you'll receive a Certificate of Eligibility (COE).This is the document that tells private lenders (such as banks, credit unions, or mortgage companies) that you have VA home loan eligibility and entitlement.

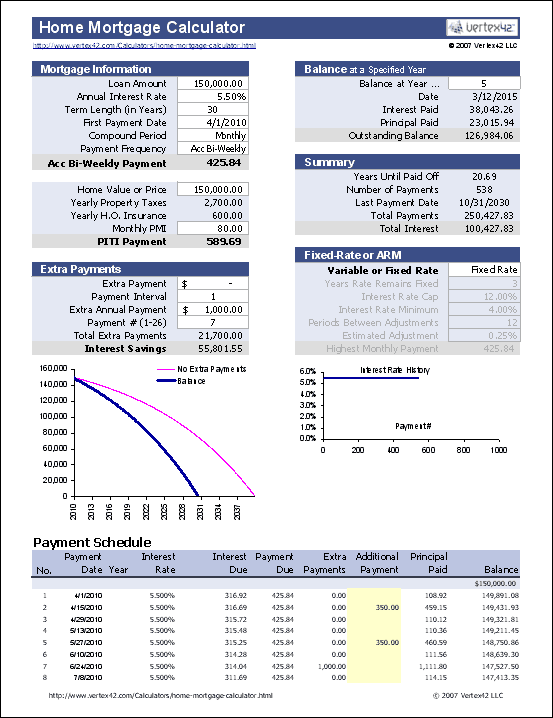

Free home mortgage calculator for excel

Free home mortgage calculator for excel

The 2020 VA loan calculator is updated to reflect the changes made by the Blue Water Navy Vietnam Veterans Act of 2019. Covering all the bases to ensure an accurate VA loan payment estimate is what makes our's the best VA loan calculator online. What is a VA loan? A VA loan is not much different than a traditional mortgage loan.

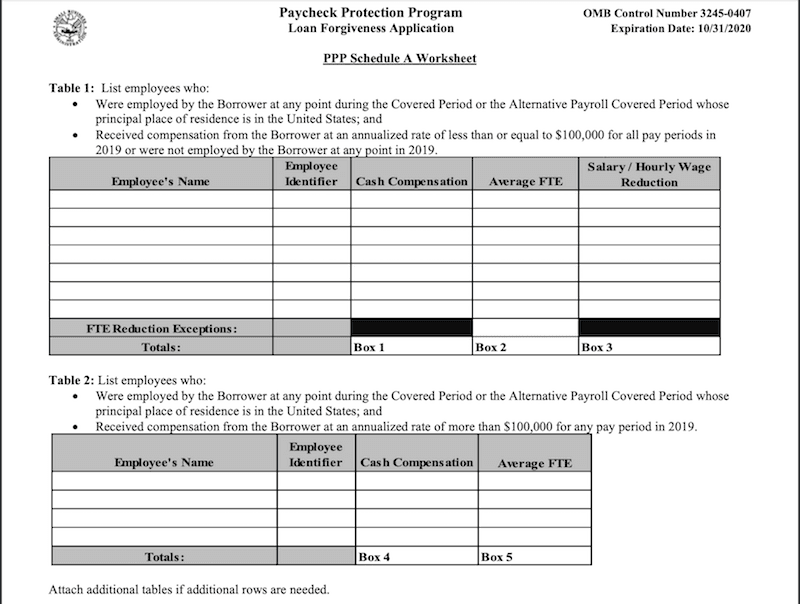

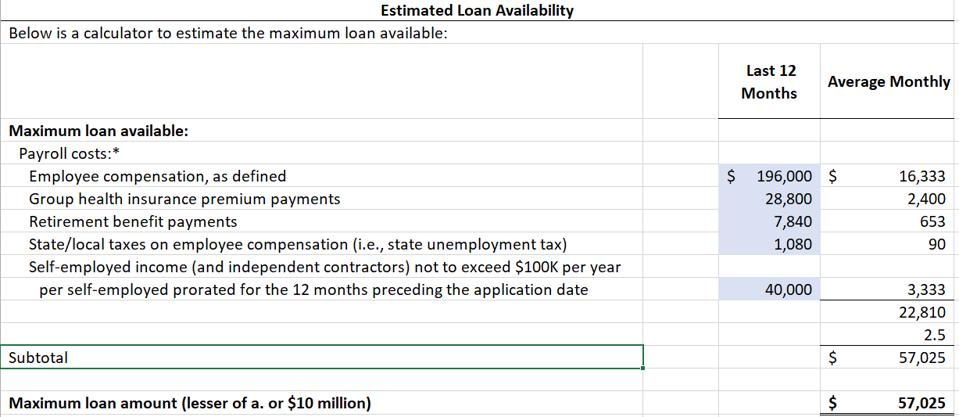

How to get 100 forgiveness on a ppp loan finder com

How to get 100 forgiveness on a ppp loan finder com

Your obligation to respond is required in order to determine the veteran's qualifications for the loan. SECTION A - LOAN DATA. OMB Control No. 2900-0523 Respondent Burden: 30 minutes Expiration Date: 08/31/2022 VA FORM AUG 2019. 26-6393. SUPERSEDES VA FORM 26-6393, JUN 2016, WHICH WILL NOT BE USED. 1. NAME OF BORROWER 2. AMOUNT OF LOAN

Va loan comparison worksheet worksheet list

Va loan comparison worksheet worksheet list

Free VA mortgage calculator to find the monthly payment, total interest, funding fee, and amortization details of a VA loan, or to learn more about VA loans. Included are options for considering property tax, insurance, fees, and extra payments. Also explore other calculators covering mortgage, finance, math, fitness, health, and many more.

Mavent compliance service rules release notes

3.2 VA Loans; 3.3 FHA Loans; 3.4 USDA Loans; 3.5 Conventional Loans; 3.6 Loan Comparison Chart; 4 Starting The VA Mortgage Process Open Section. 4.1 Where to Start: Lender or Real Estate Agent? 4.2 VA Loan Eligibility; 4.3 VA Loan Entitlement; 4.4 VA Loan Limits; 4.5 VA Loan Prequalification; 4.6 VA Loan Preapproval; 4.7 Finding a VA Lender; 5 ...

Fill free fillable flagstar bank pdf forms

Fill free fillable flagstar bank pdf forms

When you're pursuing a Joint VA Loan, the loan limits you might be eligible for are different than if you are applying for a standard VA Home Loan. When considering joint borrowers, here is how the Department of Veteran Affairs figures how much it will guarantee: (Home price) ÷ (Number of borrowers) = Y.

Va maximum entitlement worksheet printable worksheets and

Va maximum entitlement worksheet printable worksheets and

VA Loan Limit Calculator. Find out how much you can borrow for $0 down. Representatives Available 24/7 to Better Serve Troops Overseas 1-800-884-5560 Get a Quote A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Search Search. VA Home Loans ...

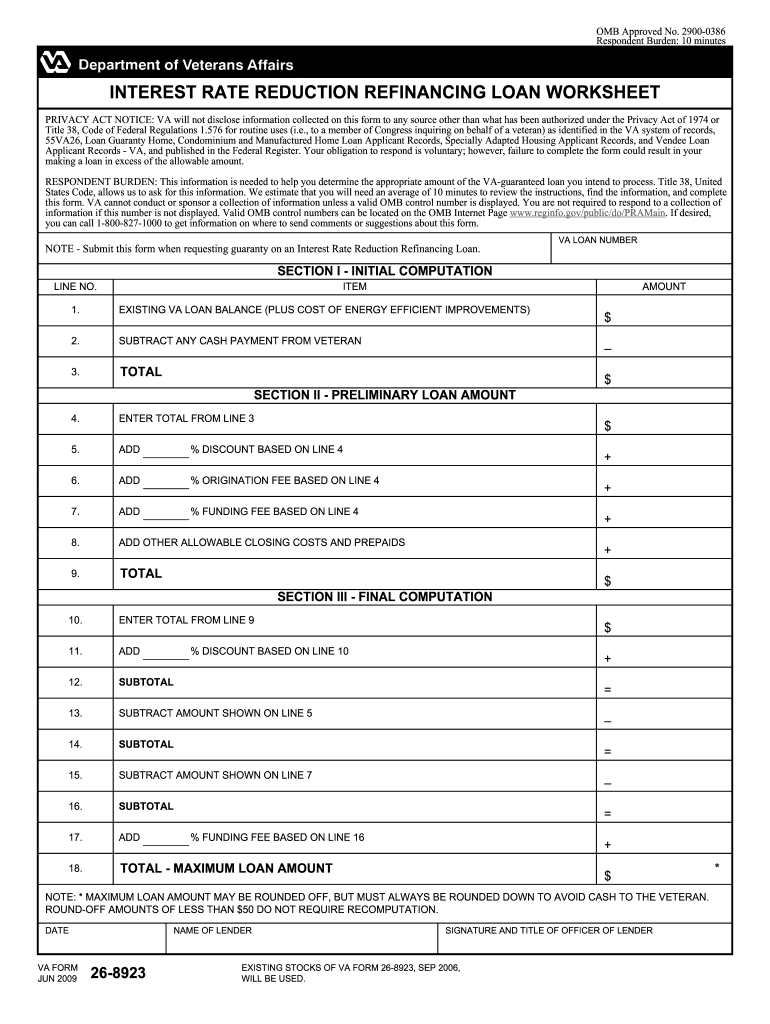

Submitting a complete loan application for conditional commitment

By default this calculator is selected for monthly payments and a 30-year loan term. A person could use the same spreadsheet to calculate weekly, biweekly or monthly payments on a shorter duration personal or auto loan. Some of Our Software Innovation Awards! Since its founding in 2007, our website has been recognized by 10,000's of other websites.

This matrix is intended as an aid to help determine whether a

Mortgage.info. NMLS ID #1237615 | AZMB #0928735. 8123 South Interport Blvd. Suite A, Englewood, CO 80112 ×

City home buyer assistance program program manual

Use the VA entitlement worksheet to calculate your maximum VA loan amount. Your new VA loan must be on an owner occupied primary residence. VA uses conforming loan limits established for Fannie Mae and Freddie Mac to determine maximum VA loan eligibility when there is entitlement in use that will not be restored.

Irrrl facts for veterans military com

Irrrl facts for veterans military com

Deciphering the VA Lender's Handbook Chapter 7 Part 4. In the last article, we went into depth on how guaranty and entitlement are calculated on a veteran/nonveteran joint loan.A veteran/nonveteran situation presents some unique difficulties in calculating guaranty because the nonveteran is not entitled to any guaranty, so only a portion of the loan is eligible for the VA guarantee.

Va streamline refinance checklist must be reducing

Va streamline refinance checklist must be reducing

Remember that the VA loan funding fee for joint loans is established based on the veteran's portion of the loan obligation, so that would be calculated using that percentage and the numbers below: First-time use with no money down – 2.3%; 5 percent down – 1.65%; 10 percent down – 1.4%; Second-time use VA loan funding fees are as follows:

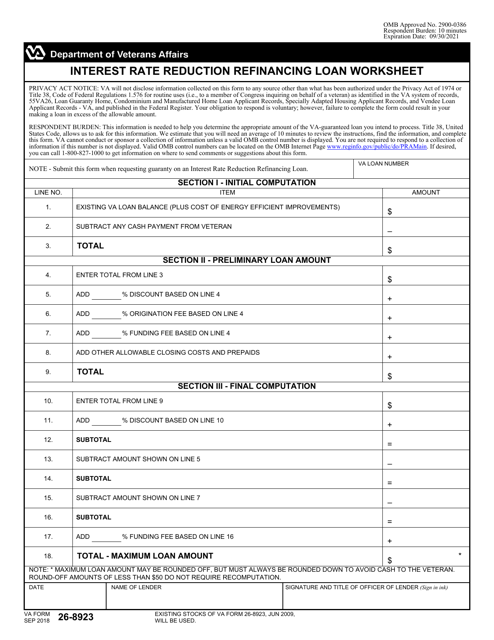

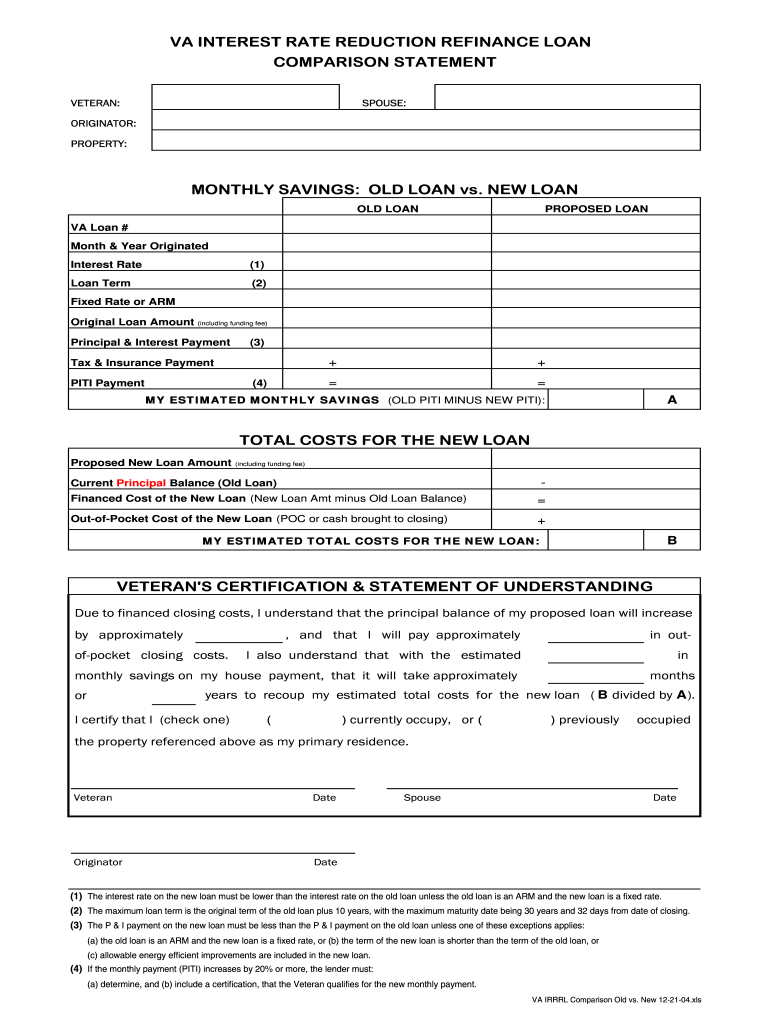

Va form 26 8923 download fillable pdf or fill online interest

Va form 26 8923 download fillable pdf or fill online interest

Va Loan Worksheet Choice Image free printable worksheets f from va maximum loan amount calculation worksheet 2018 , source:Strategicdefaultbooks The VA worksheet 2020 is a useful tool when you are looking for the maximum loan amount.

Va loan closing costs unallowable fees and seller concessions

Va loan closing costs unallowable fees and seller concessions

VA lenders calculate it to make sure you will be able to afford your loan. How do Lenders Calculate VA Residual Income? You have probably heard of debt-to-income ratio, the calculation that looks at your monthly debt payments compared to your income. The residual income calculation goes one step further and factors in other expenses like ...

Budget worksheet mariner finance

Budget worksheet mariner finance

VA Entitlement Worksheet VA Case #: Entitlement available for new loan Multiply by 75% Required Cash Downpayment/Equity Entitlement (Take from line 3) Guaranty Percentage (Cannot be less than 25%) AMOUNT + (¸) Purchase or Refinance Appraised Value per NOV Lesser of value per NOV/Sales price minus maximum loan amount Divided by lesser of Value ...

Mortgage amortization with paydown savings calculator

Mortgage amortization with paydown savings calculator

The Annual Percentage Rate (APR) is based on the loan amount and may include up to 3 points. (Points include any origination, discount and lender fees.) On adjustable-rate loans, interest rates are subject to potential increases over the life of the loan, once the initial fixed-rate period expires.

This matrix is intended as an aid to help determine whether a

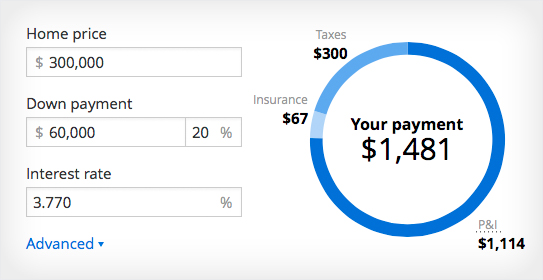

VA Mortgage Calculator. Use our VA home loan calculator to estimate your mortgage payment, with taxes and insurance. Simply enter the price of the home, your down payment, and details about the home loan to calculate your mortgage payment breakdown, schedule, and more. Your payment: $1,868/mo. Share.

Use this calculator to help estimate the monthly payments on a VA home loan. Enter your closing date, the sale price, your military status & quickly see the monthly costs of buying a home. Please remember that this is an estimate, the actual fees and expenses may change depending on a variety of factors including the actual closing date, your military status & if you finance your funding fee.

Va form 26 8923 fill online printable fillable blank pdffiller

Va form 26 8923 fill online printable fillable blank pdffiller

Veterans Administration (VA) Loan Amount Worksheet – Purchase Transaction STEP 1 The Base Loan Amount a) _____ Lesser of Sales Price or Appraised Value ... The VA Funding Fee can be added to base loan amounts $417,001 to $1,000,000 on a VA Jumbo transaction. Title: VA Loan Amount Worksheet Keywords: COR0339

Cbcma documents and tools chenoa fund down payment assistance

Cbcma documents and tools chenoa fund down payment assistance

Like so many other aspects of VA loans, the rules governing co-borrowers are designed to keep maximum flexibility without compromising the intent of the VA mortgage program. Between veteran co-borrowers, a single borrower can use all his or her VA loan entitlement, or the veterans can share the entitlement between them depending on their ...

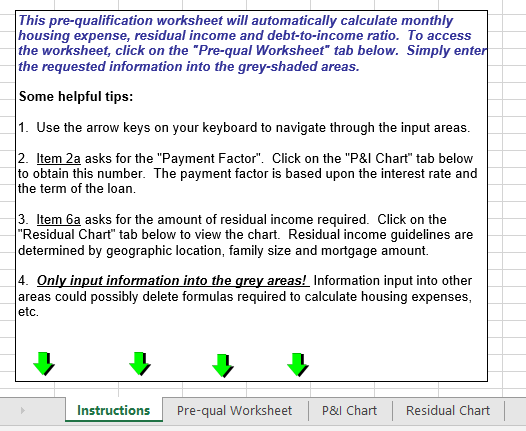

Loans practice math 107 worksheet 23 pdf free download

Loans practice math 107 worksheet 23 pdf free download

Use our VA loan calculator to determine the highest monthly payment and the maximum loan amount you can qualify for. We can help you understand how a lender looks at your ability to make payments. Use this calculator → How Much Can I Afford? The amount you can qualify for and what you can actually afford are two different things. ...

Mortgage qualification worksheet

Mortgage qualification worksheet

VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Va loan entitlement everything veterans need to know

Va loan entitlement everything veterans need to know

va form sep 2018. enter total from line 3. 26-8923. existing stocks of va form 26-8923, jun 2009, will be used. – 5. total. 7. + + 6. add % origination fee based on line 4 + add % discount based on line 10 + subtotal. 15. = total - maximum loan amount. 16. – subtract amount shown on line 7. signature and title of officer of lender (sign in ink) 17.

Get And Sign Va Entitlement Worksheet Fillable 2009-2021 Form . Of property value per NOV or Sales Price $ 5. Multiply by 75% x $ 6. Plus available entitlement (Take from line 3 above) + $ 7a Maximum Base Loan Amount* (the lesser of Line 4 or Line 6), or $ 7b 90% of NOV for regular/cash-out refinance (100% permitted if new mortgage will be to payoff existing eligible liens only) or the amount ...

Va loan comparison worksheet fill out and sign printable pdf template signnow

Va loan comparison worksheet fill out and sign printable pdf template signnow

Using the VA calculation that 25% of the home loan is guaranteed, $190,000 x 25% = $47,500. Thus, $47,500 of eligibility was used up in the first mortgage. Since we previously determined that veterans have a total entitlement of $127,600 that would mean that $127,600 – $47,500 = $80,100. The veteran still has $80,100 of entitlement available.

Paycheck protection program loans three things the sba and

Paycheck protection program loans three things the sba and

Why get a VA mortgage loan? A VA mortgage loan does not require a down payment, but may include additional costs, such as a funding fee. A funding fee is a mandatory one-time fee paid directly to the Department of Veterans Affairs (VA). The fee is a percentage of the loan amount (as high as 3.3%) and can be paid at closing or included into your ...

0 Response to "30 Va Loan Calculation Worksheet"

Post a Comment