20 Self Employed Expenses Worksheet

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 incomelisted. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. For specific information on what expenses can be claimed, please see my Self-employed income and expense worksheets. In general, there are four main categories of expenses: Expenses that are 100% related to the business and will be deducted fully in the year incurred (e.g. stationery, business cards, travel).

Self-employed taxpayers may deduct car loan interest, provided they deduct only that portion related to business use of the vehicle. Claiming the vehicle expense deduction is simple with 1040 To take a vehicle expense deduction for a business, simply add Your Business Vehicle while completing the segment of our walkthrough on self ...

Self-Employed Business Worksheet 12/20/10 Income Gross Sales Product Sales Minus ... Vehicle Expenses: (Mileage or Actual Expenses Method) ... Repairs & Tires $ Insurance Equipment/Property Insurance $ Business Liability, E & 0 Insurance $ Self-Employed Health Insurance $ Interest Paid Vehicle & Equipment Loans $ Credit Line $ Use the self-employment part of your musical instrument expenses to calculate the net self-employment income you report on line 13700 of your income tax and benefit return. For more information, see Guide T4002 , Self-employed Business, Professional, Commission, Farming, and Fishing Income . Note: You can elect to deduct or amortize certain business start-up costs. Refer to chapters 7 and 8 of Publication 535, Business Expenses.. Personal versus Business Expenses. Generally, you cannot deduct personal, living, or family expenses. However, if you have an expense for something that is used partly for business and partly for personal purposes, divide the total cost between the ...

Self-Employed Business Worksheet 12/20/10 Income Gross Sales Product Sales Minus ... Vehicle Expenses: (Mileage or Actual Expenses Method) ... Repairs & Tires $ Insurance Equipment/Property Insurance $ Business Liability, E & 0 Insurance $ Self-Employed Health Insurance $ Interest Paid Vehicle & Equipment Loans $ Credit Line $ Use the self-employment part of your musical instrument expenses to calculate the net self-employment income you report on line 13700 of your income tax and benefit return. For more information, see Guide T4002 , Self-employed Business, Professional, Commission, Farming, and Fishing Income . Note: You can elect to deduct or amortize certain business start-up costs. Refer to chapters 7 and 8 of Publication 535, Business Expenses.. Personal versus Business Expenses. Generally, you cannot deduct personal, living, or family expenses. However, if you have an expense for something that is used partly for business and partly for personal purposes, divide the total cost between the ...

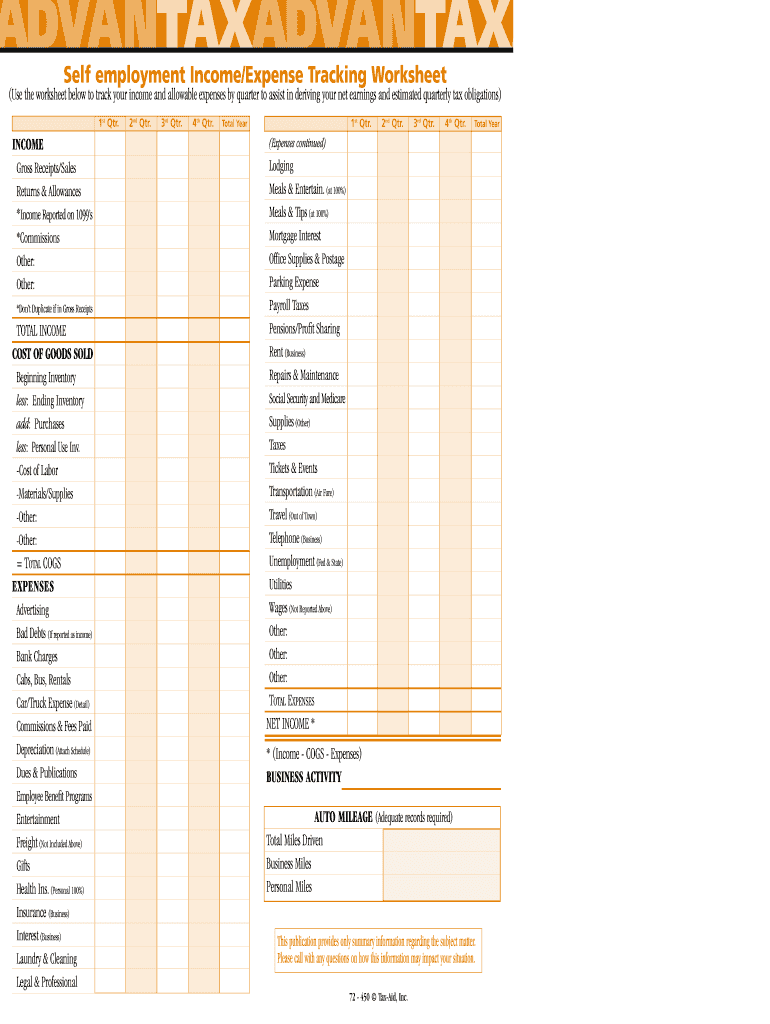

Self employed expenses worksheet. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. In the mean time we talk about Budget Worksheet Self-Employed, below we will see some related images to give you more ideas. hair salon business worksheet, self-employed income expense worksheet and self employment income worksheet template are three of main things we will show you based on the post title. You may also have to complete the Worksheet for the return (for all provinces/territories) to calculate the amount for the following lines: . line 12000, Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations line 12010, Taxable amount of dividends other than eligible dividends, included on line 12000, from taxable Canadian corporations What is self-employment tax? The self-employment tax rate is 15.3%. That rate is the sum of a 12.4% for Social Security and 2.9% for Medicare. Self-employment tax applies to net earnings — what ...

EXAMPLES OF SELF-EMPLOYED BUSINESS EXPENSES After you have visited my website, www.junewalkeronline , and read FEATURE # 3 which explains what makes an expense a business deduction, the following list will be helpful in providing you with typical as well as unusual examples of business expense deductions. There Specialty Worksheet SELF-EMPLOYED Name Business Activity Tax Year INCOME Lodging Gross Receipts/Sales Meals & Entertainment Returns & Allowances Meals & Tips Total Income Medical – Employee Related Medical Insurance COST OF GOODS SOLD Notary Fees Beginning Inventory Office Supplies – Pens, Pencils, Paper, etc. If I right-click the value->About, it says to see the "Self-Employed Health and Long-Term Care Insurance Deduction Worksheet." That worksheet (under Schedule C) shows a different (lesser) value on line 10, which is what it says it's supposed to be transferring to form 1040 sched 1 line 16. Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

Self-Employment Income Worksheet . This form is to be used when staff are obtaining self-employment information through phone contact with the consumer. Business Income . Tell us about your business income. Name of Self-employed person Case Number Type of Business Name of Business Date Business Started Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it is usually better for them to choose the actual expense method. Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction on the amount of space in ... self–employed borrower's business only to support its determination of the stability or continuance of the borrower's income. A typical profit and loss statement has a format similar to IRS Form 1040, Schedule C. Allowable addbacks include depreciation, depletion and other non–cash expenses as identified above. Think about ways that you are able to spend less. Even for household cleaning goods and such, you are able to do the specific same and save a significant amount of money. Unlike installment credit, which gives you a fixed sum of money plus a repayment schedule above a predetermined amount of period, revolving credit is open-ended. You will spare a package if you maintain certain appliances ...

Self employed income worksheet kids activities

Schedule C: Consider income, expenses and vehicle information. Each year, sole proprietors have the chore of preparing and filing Schedule C with their 1040 to show the IRS whether their business had a taxable profit or a deductible loss. (For tax years before 2019, if your business expenses were $5,000 or less for the year, you may qualify to file the short form, Schedule C-EZ.)

Business income expense worksheet

As business owners, the goal for self-employed borrowers is to maximize income yet reduce tax liability. The problem with that is reducing tax liabilities minimizes taxable income and makes qualifying for a loan more challenging. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrower's income.

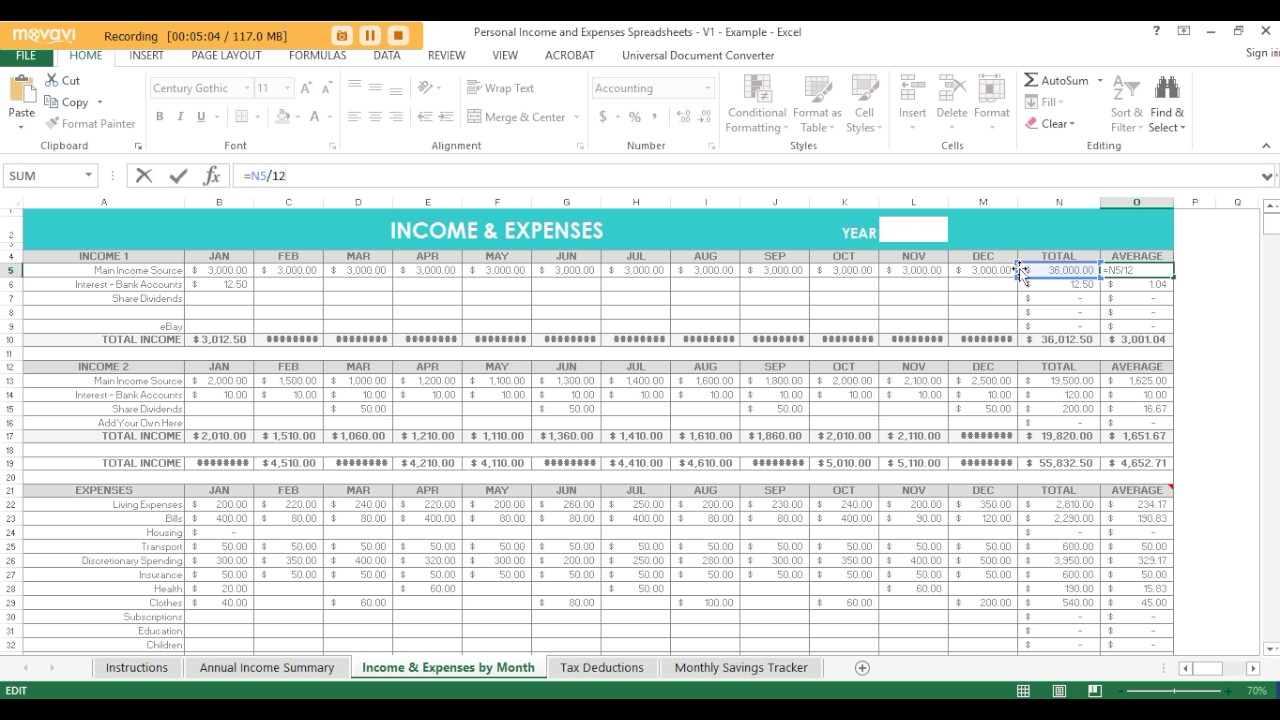

Business accounting income and expenses self employed accounting spreadsheet template

Business accounting income and expenses self employed accounting spreadsheet template

Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit.

Self employed vita resources for volunteers

Self employed vita resources for volunteers

Self-Employment Income Worksheet For Agency Use Only: Dear [Primary Applicant Name], You told us that you or someone in your household is self-employed. We need more information from you to process your application. We need proof of your self-employment income.

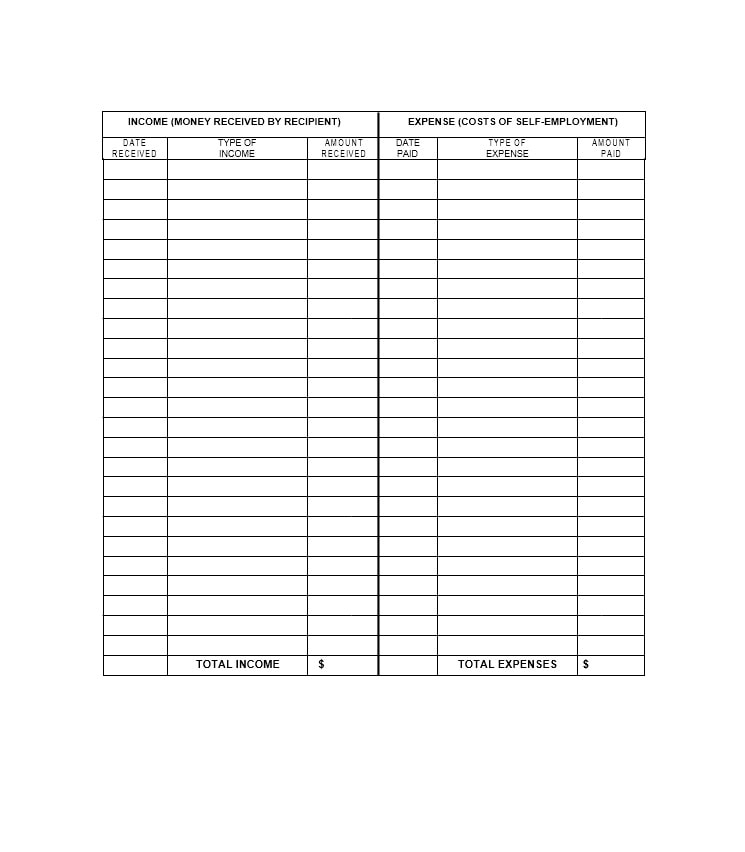

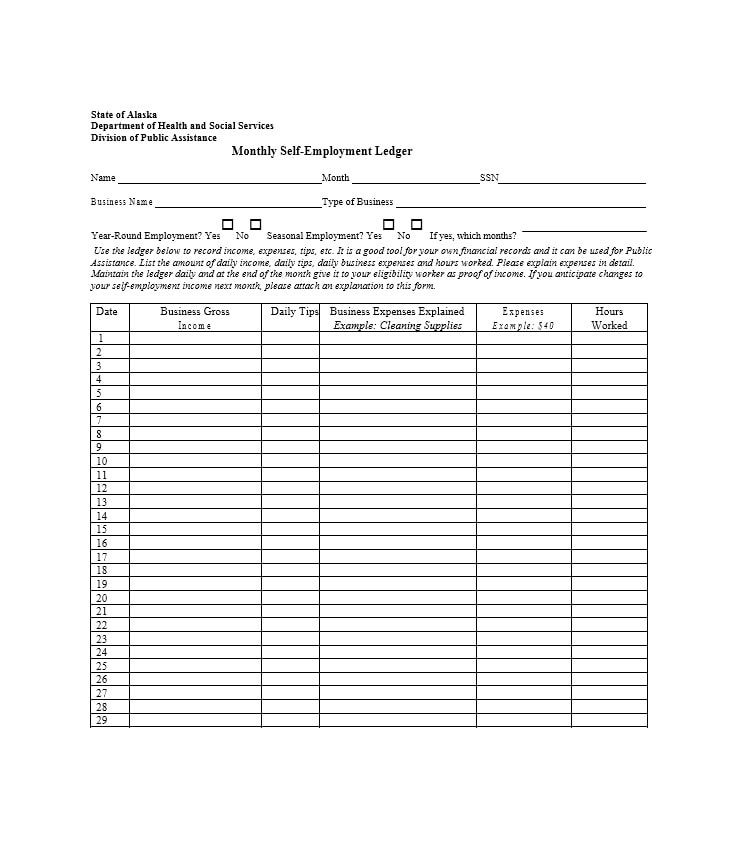

Self employment ledger 40 free templates amp examples

Self employment ledger 40 free templates amp examples

Automotive Expenses (complete auto worksheet) Office Supplies - Water Delivery. Bad Debts: Payroll Paid to Others ... SPECIALTY WORKSHEET for SELF-EMPLOYED In order to maximize your deductions, please complete this form ... Freight Attach a detailed list. Complete Cost of Goods Sold Computation. GROSS INCOME: for Self Employment only (with ...

Spreadsheet for business template xpenses and income plan

Spreadsheet for business template xpenses and income plan

Self-Employed Business Worksheet 12/20/10 Income Gross Sales Product Sales Minus ... Vehicle Expenses: (Mileage or Actual Expenses Method) ... Repairs & Tires $ Insurance Equipment/Property Insurance $ Business Liability, E & 0 Insurance $ Self-Employed Health Insurance $ Interest Paid Vehicle & Equipment Loans $ Credit Line $

10 self employment ledger samples amp templates in pdf

10 self employment ledger samples amp templates in pdf

Note: You can elect to deduct or amortize certain business start-up costs. Refer to chapters 7 and 8 of Publication 535, Business Expenses.. Personal versus Business Expenses. Generally, you cannot deduct personal, living, or family expenses. However, if you have an expense for something that is used partly for business and partly for personal purposes, divide the total cost between the ...

Free 10 business expenses worksheet samples in pdf doc excel

Free 10 business expenses worksheet samples in pdf doc excel

Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Self employed income worksheet fill out and sign printable pdf template signnow

Self employed income worksheet fill out and sign printable pdf template signnow

See IRS Publication 535 Business Expenses for additional information. To enter the self-employed health insurance deduction information within your TaxAct ® 1040 return: Schedule C Statutory Employee. From within your TaxAct return (Online or Desktop), click Federal. On smaller devices, click in the upper left-hand corner, then click Federal.

The IRS defines self-employment as carrying on a trade or business as a sole proprietor, independent contractor, single-member LLC, or as a member of a partnership. Even if your business isn't making money, as long as you're engaged in an activity that's "profit-driven" (in other words, your goal is to make money eventually), then you ...

Small business tax spreadsheet business tax deductions

Small business tax spreadsheet business tax deductions

I had more than $35,000 in business expenses I received a Form 1095-A I kept an inventory for my business I need to report a business loss I have assets to depreciate (any > $2,500) I don't use the cash method of accounting ... Self-Employed Worksheet (type-in fillable) Rev 2020-12-04. Title: Untitled Author: L S A

Using excel spreadsheets to track income expenses tax deductions and savings

Using excel spreadsheets to track income expenses tax deductions and savings

You need to set aside 15.3% of your self-employment income for the first $118,500 you earn in 2015. (12.4% Social Security and 2.9% Medicare) (12.4% Social Security and 2.9% Medicare) That's an automatic 15.3% and then you factor in federal and state taxes.

Self employment ledger 40 free templates amp examples

Self employment ledger 40 free templates amp examples

Self Employed Bookkeeping Template. The self employed bookkeeping template runs from April to March. If your accounting period is 6 th April to 5 th April, the best advice is to add the end of the year April figures into March. It keeps checking the bank figure much easier. Full instructions on using the cash book template are available here.

Income and expense worksheet for self employed natural buff

Income and expense worksheet for self employed natural buff

General partners or LLC managers- self-employment earnings include their share of all income as well as manual self-employment income adjustments.; Limited partners- self-employment earnings consist only of guaranteed payments.; Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from the 1065 form instructions,

The epic cheat sheet to deductions for self employed rockstars

The epic cheat sheet to deductions for self employed rockstars

Self-employed individuals may defer the payment of 50% of the Social Security tax imposed under section 1401(a) of the Internal Revenue Code on net earnings from self-employment income for the ...

![]() Expense tracker template in google sheets sheetgo blog

Expense tracker template in google sheets sheetgo blog

If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses.

Self employed business expenses worksheet printable

Self employed business expenses worksheet printable

11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040, Schedule 1, line 16 as an adjustment to income. 12.

Use financial software—like QuickBooks® Self-Employed—to track expenses throughout the year and automatically post the expenses as deductions. For more tax-time tips, check out our guide to taxes for the self-employed. To find expenses that may qualify for a personal deduction, see our article on Schedule A deductions. Finally, to see a ...

Income expense spreadsheet awesome for expenses personal and

Determining a self-employed borrower's income isn't always straightforward. That's why we've developed several self-employed borrower calculators to help you calculate and analyze their assets properly.

Expense printable forms worksheets expenses printable

Expense printable forms worksheets expenses printable

Whether you are fully self-employed, or have a full-time job and earn self-employed income on the side, the Income Tax Act (ITA) provides guidelines which allow you to deduct a range of business expenses.These expenses are necessary to offset your net income, lowering your income and reducing your taxes owing. These guidelines are limited to a few specific items, which means that the Canada ...

0 Response to "20 Self Employed Expenses Worksheet"

Post a Comment